- Chandigarh UT

- Creative Corner

- Dadra Nagar Haveli UT

- Daman and Diu U.T.

- Department of Administrative Reforms and Public Grievances

- Department of Biotechnology

- Department of Commerce

- Department of Consumer Affairs

- Department of Industrial Policy and Promotion (DIPP)

- Department of Posts

- Department of Science and Technology

- Department of Telecom

- Digital India

- Economic Affairs

- Ek Bharat Shreshtha Bharat

- Energy Conservation

- Expenditure Management Commission

- Food Security

- Gandhi@150

- Girl Child Education

- Government Advertisements

- Green India

- Incredible India!

- India Textiles

- Indian Railways

- Indian Space Research Organisation - ISRO

- Job Creation

- LiFE-21 Day Challenge

- Mann Ki Baat

- Manual Scavenging-Free India

- Ministry for Development of North Eastern Region

- Ministry of Agriculture and Farmers Welfare

- Ministry of Chemicals and Fertilizers

- Ministry of Civil Aviation

- Ministry of Coal

- Ministry of Corporate Affairs

- Ministry of Culture

- Ministry of Defence

- Ministry of Earth Sciences

- Ministry of Education

- Ministry of Electronics and Information Technology

- Ministry of Environment, Forest and Climate Change

- Ministry of External Affairs

- Ministry of Finance

- Ministry of Health and Family Welfare

- Ministry of Home Affairs

- Ministry of Housing and Urban Affairs

- Ministry of Information and Broadcasting

- Ministry of Jal Shakti

- Ministry of Law and Justice

- Ministry of Micro, Small and Medium Enterprises (MSME)

- Ministry of Petroleum and Natural Gas

- Ministry of Power

- Ministry of Social Justice and Empowerment

- Ministry of Statistics and Programme Implementation

- Ministry of Steel

- Ministry of Women and Child Development

- MyGov Move - Volunteer

- New Education Policy

- New India Championship

- NITI Aayog

- NRIs for India’s Growth

- Open Forum

- PM Live Events

- Revenue and GST

- Rural Development

- Saansad Adarsh Gram Yojana

- Sakriya Panchayat

- Skill Development

- Smart Cities

- Sporty India

- Swachh Bharat (Clean India)

- Tribal Development

- Watershed Management

- Youth for Nation-Building

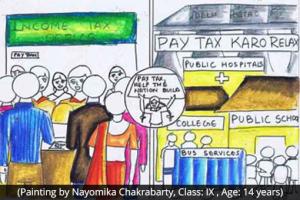

Inviting innovative ideas and suggestions on tax policy and administration

Start Date :

Sep 18, 2015

Last Date :

Mar 01, 2016

00:00 AM IST (GMT +5.30 Hrs)

One of the key priorities of the Government is to provide a non-adversarial and a responsive tax administration with the main objective of creating an environment conducive for ...

All Comments

New Comments

Comments (17)

Comments (17)

Comments (5)

Comments (5)

Comments (1)

Comments (1)

Comments (9)

Comments (9)

Comments (1)

Comments (1)

Comments (1)

Comments (1)

Comments (3)

Comments (3)

Comments (3)

Comments (3)

Comments (3)

Comments (3)

Comments (6)

Comments (6)

Showing 1495 Submission(s)

Avinash B S_1

10 years 6 days ago

The rule and regulations made for Income tax are not amended at the rate of inflation in the country.

Bangalore has grown a lot and the living expense are also higher. I would be great if you can consider Bangalore as metro and provide HRA exemption of 50% of basic

Nowadays a earning person cannot run the family within 2.5 LPA (tax exemption limit). It has to be increased to a reasonable extent so that it will be helpful.

Like

(15)

Dislike

(2)

Reply

Report Spam

Vipul Jasani

10 years 6 days ago

Reduce procedures and paper work in every day life of common man.

Just give recent example. My father-in-law expired on 31st Jan 2016.

Till date not recd the death certificate!!!

Even do not have idea when will we get!!

Need lot of reforms to make common man life easier.

Most of tje people be individual or business, all are busy meeting various compliances and rules laid down by various govt bodies that only promotes corruption due to lack of knowledge and ridiculous laws.

Like

(8)

Dislike

(0)

Reply

Report Spam

Vipul Jasani

10 years 6 days ago

Policies should promote skills based employment rather than investment based.

pro capital investment based policies will lead to more unemployment and loss of revenue for Govt.

Monster of inequality is growing very fast and that will create lot of antisocial activity such as crimes and terrorisms.

This problem can only be solved by small businesses.

FDI and foreign money is dangerous.

we do not require bullet trains. It is rubbish idea.

Like

(2)

Dislike

(1)

Reply

Report Spam

Vipul Jasani

10 years 6 days ago

First and foremost, Govt. Should focus in increasing revenue without affecting poor and middle class people.

this can be achieved by bringing in innovative tax structure and reduction in expenditure.

It is also important to increase economic activity through innovative policies. Few suggestions.

1. Remove direct tax and increase indirect taxes.

2. Tax every inch of land in use. Tax heavily not in use.

3. Remove tax benefit to house loans except own house. It cant be rented.

4. PromoteSME

Like

(4)

Dislike

(0)

Reply

Report Spam

AMITABH ANAND

10 years 6 days ago

Dear Sir some working required on financial nd currency mkt front.Especially looking on PSU banking sector sir

Like

(1)

Dislike

(0)

Reply

Report Spam

Nitin Pathak

10 years 1 week ago

Government spending much money in scholarships, fees for reserved category student. They are paying less and getting more scholarships.

It is better if government can provide equal and total free education for all without any scholarship. If the education is free and same for all then this caste factor will lapse.I don't thing there will much financial burden.

Like

(5)

Dislike

(1)

Reply

Report Spam

Nitin Pathak

10 years 1 week ago

Government is calculating tax on individual basis but it should be calculated on joint family basis too. Suppose a family having 6 members in which only 1 person is salaried. He has to feed his family, education, marriage and purchase house. which is not easy task for single earner. In other way a family of 5 members and all earning much. Then they can easily effort all things and easily contribute good money for nation building. We can focus on this area also.

Like

(10)

Dislike

(2)

Reply

Report Spam

VISHAL JAIN_5

10 years 1 week ago

THERE MUST BE "TAX SUBSIDY " AS WE DO IN "LPG DBTL"

INCOME BELOW 2.5 LACS, FILE INCOME TAX RETURN , CALCULATE TAX AT RATE OF 5% AND PAY TAX TO GOVERNMENT KITTY, BY THE END OF NEXT MONTH , GET YOUR TAX REFUND IN YOUR BANK ACCOUNT LINKED TO YOUR PAN. 100% SUBSIDY ON TAX, AND GOVERNMENT HAS GOT CRUCIAL DATA REGARDING INCOME GROUPS WHICH IS LIABLE TO PAY TAX, BUT DO NOT PAY ANY.

Like

(6)

Dislike

(0)

Reply

Report Spam

VISHAL JAIN_5

10 years 1 week ago

THERE MUST BE A QUOTA SYSTEM IN TAX ALSO.. I AM DEPRIVED OF GOVERNMENT JOB/EDUCATION/AND ALL PREVILAGES DUE TO RESERVATION AND STILL I PAY TAX TO SUPPORT THIS RESERVATION SYSTEM.. TAKE TAX FROM THOSE WHO ARE BENEFECIARIES OF RESERVATION.

Like

(11)

Dislike

(1)

Reply

Report Spam

VISHAL JAIN_5

10 years 1 week ago

CIBIL RELATED: WHILE ALL OF GOVERNMENT'S FOCUS IS ON "MAKE IN INDIA" AND TECHNOCRATS OF INDIA ARE SPREAD ALL OVER WORLD TO MAKE SOFTWARES AND BACK END, SUPPORT TO ENTIRE WORLD, WE ARE PAYING FOR OUR CREDIT SCORE TO A FOREIGN ENTITY.. WHILE WE ARE MORE THAN CAPABLE TO DO SO IN OUR OWN COUNTRY.. SHARING SENSITIVE INFORMATION WITH OUTSIDERS CAN PROVE TO BE SHORTSIGHTED IDEA.

Like

(8)

Dislike

(1)

Reply

Report Spam

- View More