- Chandigarh UT

- Creative Corner

- Dadra Nagar Haveli UT

- Daman and Diu U.T.

- Department of Administrative Reforms and Public Grievances

- Department of Biotechnology

- Department of Commerce

- Department of Consumer Affairs

- Department of Industrial Policy and Promotion (DIPP)

- Department of Posts

- Department of Science and Technology

- Department of Telecom

- Digital India

- Economic Affairs

- Ek Bharat Shreshtha Bharat

- Energy Conservation

- Expenditure Management Commission

- Food Security

- Gandhi@150

- Girl Child Education

- Government Advertisements

- Green India

- Incredible India!

- India Textiles

- Indian Railways

- Indian Space Research Organisation - ISRO

- Job Creation

- LiFE-21 Day Challenge

- Mann Ki Baat

- Manual Scavenging-Free India

- Ministry for Development of North Eastern Region

- Ministry of Agriculture and Farmers Welfare

- Ministry of Chemicals and Fertilizers

- Ministry of Civil Aviation

- Ministry of Coal

- Ministry of Corporate Affairs

- Ministry of Culture

- Ministry of Defence

- Ministry of Earth Sciences

- Ministry of Education

- Ministry of Electronics and Information Technology

- Ministry of Environment, Forest and Climate Change

- Ministry of External Affairs

- Ministry of Finance

- Ministry of Health and Family Welfare

- Ministry of Home Affairs

- Ministry of Housing and Urban Affairs

- Ministry of Information and Broadcasting

- Ministry of Jal Shakti

- Ministry of Law and Justice

- Ministry of Micro, Small and Medium Enterprises (MSME)

- Ministry of Petroleum and Natural Gas

- Ministry of Power

- Ministry of Social Justice and Empowerment

- Ministry of Statistics and Programme Implementation

- Ministry of Steel

- Ministry of Women and Child Development

- MyGov Move - Volunteer

- New Education Policy

- New India Championship

- NITI Aayog

- NRIs for India’s Growth

- Open Forum

- PM Live Events

- Revenue and GST

- Rural Development

- Saansad Adarsh Gram Yojana

- Sakriya Panchayat

- Skill Development

- Smart Cities

- Sporty India

- Swachh Bharat (Clean India)

- Tribal Development

- Watershed Management

- Youth for Nation-Building

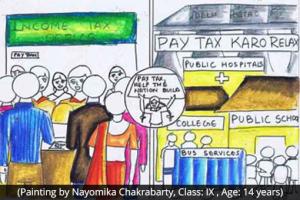

Inviting innovative ideas and suggestions on tax policy and administration

Start Date :

Sep 18, 2015

Last Date :

Mar 01, 2016

00:00 AM IST (GMT +5.30 Hrs)

One of the key priorities of the Government is to provide a non-adversarial and a responsive tax administration with the main objective of creating an environment conducive for ...

Sir, savings limit for IT exemption to be raised to 2.5 lakhs pa. All transactions to be brought under tax net. At presented billing & taxation at small & medium vendors is very poor. Cashless transaction is the best remedy for effective tax collection. Home loan tax exemption to be raised to 2.5 lakhs pa. IT slabs to be revised due to 7 cpc implementation. All sources of income to be equally treated & taxed. Subsidies misuse to be controlled by proper selection of beneficiary.

Can IT dept provide Company newly listed under MCA India to get PAN/TAN card by validating with digital signature/Adhaar card of board of directors of company and individuals applying for PAN can submit forms by validating adhaar card OTP system.these removes a lot of paper work & steps as well

3. Government should control Groceries + Food + Vegetables Prices & Stock Directly from Farmers, No intermediate should come a strong rule of 5 year Jail should be there.

4. Train, Flight & Bus tax can be reduce

5. Government should control Properties rates, for a developing area, high-rise building it should not go extend a certain limit. For Villas & other Properties that can be on builder hands. But Peoples should get there dream homes in a affordable cost

I would to suggest following for Budget 2016-17

1. Tax slabs needs to change now since inflation and everything increased, so 0-5L - no tax, 5L to 10L - 10%, 10-15L -20% and above 15L - 30%

2. An individual (salaried) paying income tax, then service tax, VAT, SBC, tax on Groceries items, etc.why so many taxes, effective earning per year for a middle class is nothing..pls stremline taxes. Only one tax should be applicable.

Following

For Railway income (part of budget)

Each railway station can be named with private parties. The privates parties will be selected based on open ONLINE competitive bidding. the selected company will be responsible for maintenance and ownership of advertisement within the station. For example, IF Gopi is the selected bidder for Chennai Central station, the station will be renamed as Gopi-Chennai Central station. Similarly Dabur-Mumbai, Reliance-Delhi. Contract period can be 5 years

I would to suggest following for Budget 2016-17

1. Tax slabs needs to change now since inflation and everything increased, so 0-5L - no tax, 5L to 10L - 10%, 10-15L -20% and above 15L - 30%

2. Medical expenses of Rs 15k is very less, it shall be minimum 30K for a year.

3. an individual (salaried) paying income tax, then service tax, VAT, SBC, etc...why so many taxes, effective earning per year for a middle class is nothing..pls stremline taxes and reduce burden on middle class.

-Manish Gupta

Section 234B(3)- To require an assessee to pay interest from the very beginning on an amount of tax he did not know earlier as payable, or contested as not payable, is not equitable. For equity, and to discourage wilful non-compliance, the Act provides for levy of Penalty in suitable cases of concealment. Interest on such tax should be payable only from the date of final determination of demand, and penalty is the right instrument to enforce voluntary compliance.

Section 111A - 15% tax on short term capital gain is applied even in cases of individual assessee who otherwise fall in 10% tax bracket. Such assessees have to pay extra 5% as income tax even though they fall in lower tax bracket. This should be corrected.

Property rate in Metros like Delhi/NCR is very high as compared to circle rate. It is as high as 3 times. The stamp duty rate is 6 % approx. My suggestion is to reduce the stamp duty rate by 3 times and increase the circle rate by 3 times. This will be revenue neutral and expense neutral to both Govt and citizen. But due to increase circle rate, more white money will be required. This will increase the Income Tax collection and reduce speculation in property.

Govt should increase the focus of people on medi claim policy by providing more benefits. One of them could be to force insurance companies to give more return to people having both Medi claim and Life Insurance. This will attract people and insurance company will also be benefited because of more business. As people will get good healthcare facilities so less claims as well.