- Chandigarh UT

- Creative Corner

- Dadra Nagar Haveli UT

- Daman and Diu U.T.

- Department of Administrative Reforms and Public Grievances

- Department of Biotechnology

- Department of Commerce

- Department of Consumer Affairs

- Department of Industrial Policy and Promotion (DIPP)

- Department of Posts

- Department of Science and Technology

- Department of Telecom

- Digital India

- Economic Affairs

- Ek Bharat Shreshtha Bharat

- Energy Conservation

- Expenditure Management Commission

- Food Security

- Gandhi@150

- Girl Child Education

- Government Advertisements

- Green India

- Incredible India!

- India Textiles

- Indian Railways

- Indian Space Research Organisation - ISRO

- Job Creation

- LiFE-21 Day Challenge

- Mann Ki Baat

- Manual Scavenging-Free India

- Ministry for Development of North Eastern Region

- Ministry of Agriculture and Farmers Welfare

- Ministry of Chemicals and Fertilizers

- Ministry of Civil Aviation

- Ministry of Coal

- Ministry of Corporate Affairs

- Ministry of Culture

- Ministry of Defence

- Ministry of Earth Sciences

- Ministry of Education

- Ministry of Electronics and Information Technology

- Ministry of Environment, Forest and Climate Change

- Ministry of External Affairs

- Ministry of Finance

- Ministry of Health and Family Welfare

- Ministry of Home Affairs

- Ministry of Housing and Urban Affairs

- Ministry of Information and Broadcasting

- Ministry of Jal Shakti

- Ministry of Law and Justice

- Ministry of Micro, Small and Medium Enterprises (MSME)

- Ministry of Petroleum and Natural Gas

- Ministry of Power

- Ministry of Social Justice and Empowerment

- Ministry of Statistics and Programme Implementation

- Ministry of Steel

- Ministry of Women and Child Development

- MyGov Move - Volunteer

- New Education Policy

- New India Championship

- NITI Aayog

- NRIs for India’s Growth

- Open Forum

- PM Live Events

- Revenue and GST

- Rural Development

- Saansad Adarsh Gram Yojana

- Sakriya Panchayat

- Skill Development

- Smart Cities

- Sporty India

- Swachh Bharat (Clean India)

- Tribal Development

- Watershed Management

- Youth for Nation-Building

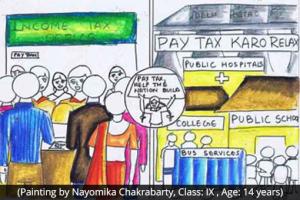

Inviting innovative ideas and suggestions on tax policy and administration

Start Date :

Sep 18, 2015

Last Date :

Mar 01, 2016

00:00 AM IST (GMT +5.30 Hrs)

One of the key priorities of the Government is to provide a non-adversarial and a responsive tax administration with the main objective of creating an environment conducive for ...

the tax policy should be such a normal person can easily spend on her daily life,in name of development people of india being charged 60% of there income including direct and indirect taxes. firslty the people of india should get realxed in taxes. these can be done by giving relaxing in diresct tax and increase indirect tax.Definately by realxing in direct taxes the money will come in market and govt. can generate more tax from indirect taxes and the revenue will also increase

Sir,

when we work we get a salary or a profit from the business..then we pay a tax on that amount as Income Tax ..now my already taxed money is used to buy things, or consume or get a service where in the govt retax my money for VAT, Service Tax, Luxury tax, etc (Indirect Tax)... Of my little understanding the Govt has double tax avoidance treaty with many countries so that the money once tax will not be further taxed until a value addition to it is committed...Can't we do away wt Income tax.

i have read the piece on deen dayaljee . the best part i liked is the predictable tax system. a little more or a little less is no concern. 5 years from what would be my tax liability is. hence the attraction of predictability.

i would even suggest predictable and simple mechansism for defence response too. almost a tit tat table . for this action this reaction. it will dissuade the enemy from venturing into test moves. an incursion to test our response. which is a regualr feature now

Respected Sir, In our Income Tax Department there is a system of Refund of Tax. Sir an Assessee can not adjust his refund of one year with his tax liability of Next Year. For Example ABC Ltd. eligible for refund 1,00,000/- for A.Y.2014-15 But have tax liability for A.Y.2015-16 1,50,000/-. Now in present system GOvt will pay him 1,00,000/- and he will pay to govt. 1,50,000/-. Effect of that is Income Tax deptt busy, Bank Busy and Assessee Busy. Refund should be adjusted against liability.

Respected Si, In India there are people in Lacs who have very good business having very good earning but not paying tax and not submitting return. For example shop keeper in Delhi. They have very good earning but not paying sales tax and Income tax and govt. have no channel to trace them.Sir, Every shopkeeper in City should be compulsory to have TIN no. (Sales Tax No.).When wholesaler should be compulsory to sold their goods only Registered Dealer. Govt will get sales tax as well as Income Tax

As in Loksabha Elections People of India had elected Modi Government on party's tagline " Sabka Sath Sabka Vikas". From Every corner of country there was contribution of each people in Modi Sarkar's Victory , weather he could be of any caste , any state or any religion. At the same time people from each group , each state are expecting that modi govt. will do something for them. Please Don't overlook them, they have deep faith in you Sir, including me. Please make a transparent policy for all

Respected Sir,

Indirect Tax in India on Goods is not paid property by dealers. There is a big mistake that Manufacture who produce the Goods sold the goods to wholesaler etc without bill or underbill. If Central Govt. CBEC control such manipulation than Govt can earn Excise, Sales Tax and Income Tax. Mother of such corruption is MANUFACTURER.

Regards

Respected Sir,

In India most of the Black money is used to acquired Land, Building and Flats. There is a very easy way to link that property with AADHAR No. When govt link it than Govt. will come to know that Govt employee and many person who have not paid a single penny to Govt as Tax have purchase property valued in Crores. Every Sale Purchase of property should also be reported to GOvt. through AADHAAR Return by the Registration Authority. Also House Tax can be AADHAR LINKED

Increase the 10% income tax slab upto Rs 10 lakhs, 15% upto Rs 15 lakhs and 20% upto 20 lakhs.

There are so many court cases claiming that the huge payments were made in cash for some land or building purchase but the parties deferred. Hence these kind of huge-cash transacted court cases shall be linked to IT database. These cases shall be treated under black money cases, as is being done for foreign assets.

Make the IT payments by individuals as simple slabs, without any clauses for deductions, so that every common man can assess his tax liability.